One doesn’t need to look too far back in time to arrive at a place where accounting and finance departments across the world were completely manual process focused and the sheer thought of interconnected systems and automated processing would have seemed somewhat futuristic and way out of reach of your average company.

The adoption of multi-functional cloud computing platforms to replace clunky and dated mainframe systems and process has accelerated in the past decade but if you were to step into an average accounting and business operations department in 2021, you would be surprised at how many processes are still manually undertaken on a day-to-day basis and in turn, how these organisations are at risk of falling behind the Hyperautomation curve.

For today’s Finance Director, driving innovation within their own department and across the wider organization is one of the most important parts of their remit and many are under pressure to do within an ever-changing technological landscape. Finance teams across all sectors are increasingly swamped with tighter deadlines, requests for faster and more accurate information and tend to operate in a cycle of never-ending monthly processing and reporting, while being required by the business to make strategic decisions at pace.

The range of automation possibilities within a finance department are endless but it’s often difficult to know where to start on this journey. A few examples of quick wins that can be achieved in a relatively short space of time and which can deliver significant ROI are end-to-end accounts payable processing, order to cash functionality and the involvement of automation technology in the accounting month end close process.

One of the technology stacks most suited to speeding up and optimizing manual work within the back office is Robotic Process Automation which has evolved significantly and become widely adopted across the globe in the past few years. Simply put, a robot is configured to tackle repetitive and predictable tasks across a function, eliminating human error and producing results at a significant pace, allowing finance teams to work on more important tasks such as data analysis, management reporting and ultimately increasing meaningful output.

One of the advantages RPA has is that it is a non-invasive technology so you can use the existing systems you have without having to create new technical integration points or replacement systems to achieve your quick automation wins.

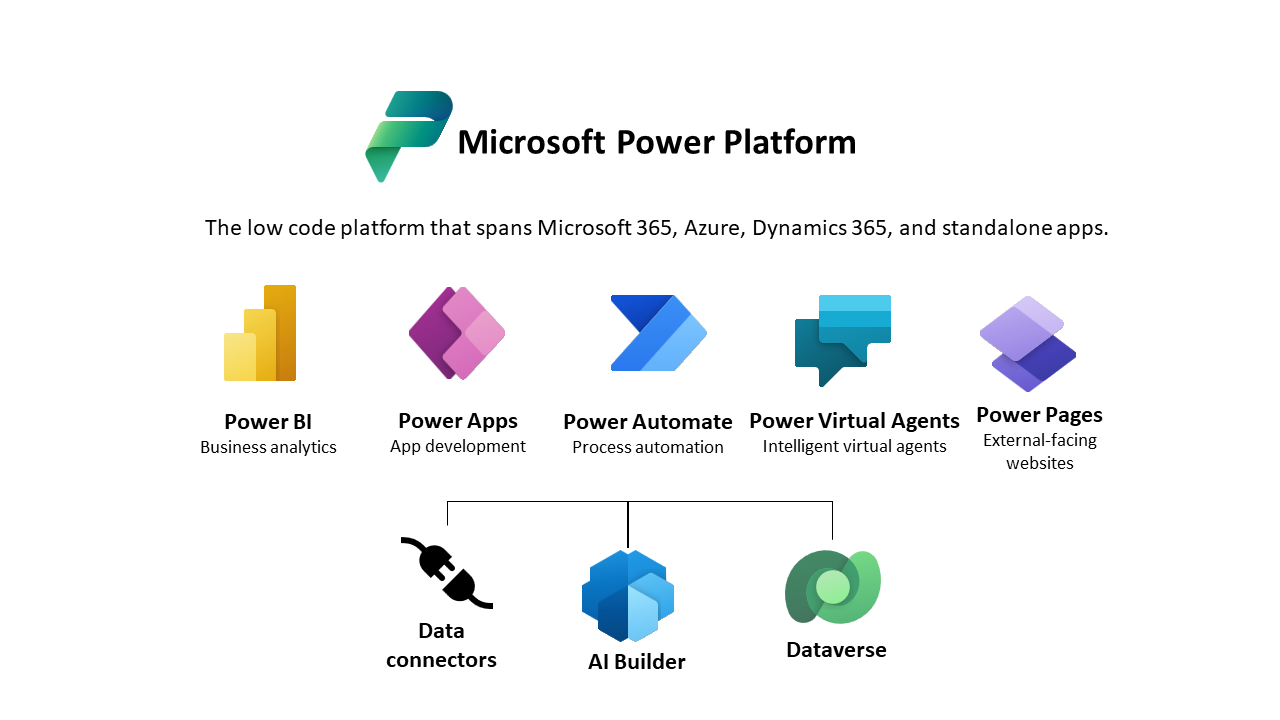

Once you have made your quick wins you can then combine the process and system agnostic power of RPA with other automation technologies such as Workflow, document generation, digital signatures and Practical Ai. By utilising these technologies it is entirely possible for a manual process heavy finance team to operate in a whole new world of efficiency.

Within this kind of team and across the organization, the possibilities for automation are endless; by leveraging the connectivity, delegation and reporting capabilities of workflow on top of a combination of both RPA, Chatbots and machine learning technologies, Finance Directors can introduce digital members of their team at pace and scale up or down as the business grows.

When you consider the challenges facing finance leadership in 2021, it would be natural to assume that the various technology choices and vendors in the market that are available to tackle this crucial element of modern business could be overwhelming. At jaam, our role is to advise you on all aspects of automation and help you succeed with the best technology offerings and solutions for your business.